5. choosing a business structure

Once you have decided to progress with your business, you need to choose a legal structure for it. The most common types include:

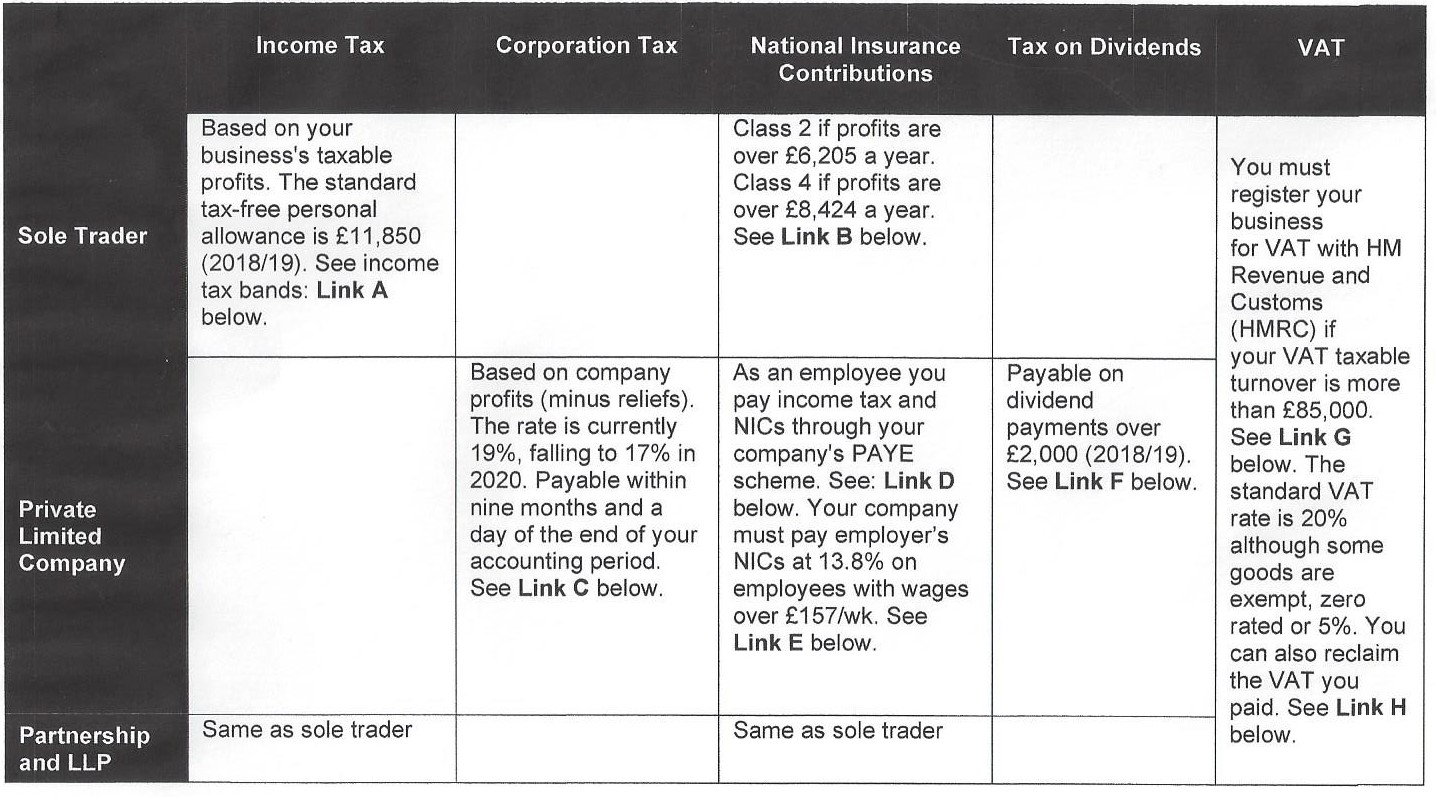

Sole trader

If you're a sole trader, you run your own business as an individual and are self-employed. You can keep all your business's profits after you've paid tax on them. You're personally responsible for any losses your business makes. See GOV.UK and also Bytestart.co.uk for information on how to proceed.

Pros: You can start up quickly, make your own decisions, no fees to pay, no red tape, just inform HMRC that you are working as self employed. Best if you don’t intend to hire anyone. More pros can be found here.

Cons: You have unlimited liability for your business, meaning that you are personally responsible for any business debts or if a customer sues you. Lacks credibility in the market. You are likely to pay more tax.

Limited company

A limited company is legally separate from the people who run it, has separate finances from your personal ones and can keep any profits it makes after paying tax. See GOV.UK for information on how to proceed.

Pros: The business itself (rather than its directors) bears the financial liability if the company goes under. You are likely to pay less personal tax. This structure has more credibility in the market. More advantages can be found here.

Cons: More administrative requirements, for example annual accounts must be filed at Companies House (and therefore in the public domain), and an annual corporation tax return must be made, although this can be done by an accountant. There is no legal requirement for small companies to use an accountant, however and there are a number of online accounting packages that you may consider using instead. There are also a number of good reasons to use an accountant, as explained by companybug.com.

Partnership

In a partnership, you and your partner (or partners) personally share responsibility for your business. This includes any losses your business makes, bills for things you buy for your business, like stock or equipment. Partners share the business’s profits, and each partner pays tax on their share. A partner doesn’t have to be an actual person. For example, a limited company counts as a ‘legal person’ and can also be a partner. The pros and cons are similar to those of a sole trader, and as all partners are personally responsible for the entire company debt, you must choose partners you can trust. See GOV.UK for information on how to proceed.

Limited liability partnership (LLP)

Mainly used by professional services companies, for example, in accountancy or law. You can set up a limited liability partnership to run a business with two or more members. A member can be a person or a company, known as a ‘corporate member’. Each member pays tax on their share of the profits, as in an ordinary business partnership, but isn’t personally liable for any debts the business can’t pay. See GOV.UK for information about how to proceed.

Additional structures which may be of interest include:

Community Interest Company (CIC)

A CIC is a special type of limited company which exists to benefit the community rather than private shareholders. See GOV.UK for information about how to proceed.

Franchise

Franchising is when an established business allows a third party the right to operate using their trade-name, either through their manufacturing, distribution or sales channels. This is usually in return for a one time franchise fee, plus a percentage of sales revenue. See Reed.co.uk for further information. Also see Buying a franchise after retirement and Buy a franchise.